Salary Slip Portal – Ministry of Finance and Planning, Tanzania,Salary Slip Portal Register | Salary Slip Login 2022/2023,Kupata hati ya Mshahara (Salary slip) – Tamisemi,Salary Slip Portal – salaryslip.mof.go.tz, Watumishi portal salary slip 2022

Salary Slip Portal 2022 Tanzania,Namna ya Kupata Salary Slip,My Salary Slip, Kupata Salary Slip Online,Hati ya Mshahara Tanzania,How can I get my Salary Slip Online in Tanzania, Can we get Salary slip Online,Kupata hati ya Mshahara Tanzania,Register,Download

Salary Slip Portal Tanzania 2022/2023 Salary Slip portal provides a totally new way for Tanzanian government employees to apply Payslip online. The online payslip service can be utilized in many ways.

Salary Slip Portal is a Government of Tanzania Salary Slip system for their employees and servants. So the system is all about giving convenience to government employees regarding online Salary Slip. Salary slip also known as a pay slip is provided to employees to record their monthly pay and allowances.

Other Posts

Download Your NIDA number | Copy Online | National ID (NIDA) – Kitambulisho cha Taifa

Vitambulisho vya Ujasiriamali Tanzania – Apply Online

It is a document that makes the employees aware of their incomes and deductions as it would differ from employee to employee. In this article, we look at Salary Slip Portal Tanzania by Tanzania Government Provided by Ministry of Finance and Planning (salaryslip.mof.go.tz).

Salary Slip Portal register 2022 and Salary Slip Portal Login (salaryslip.mof.go.tz) information.

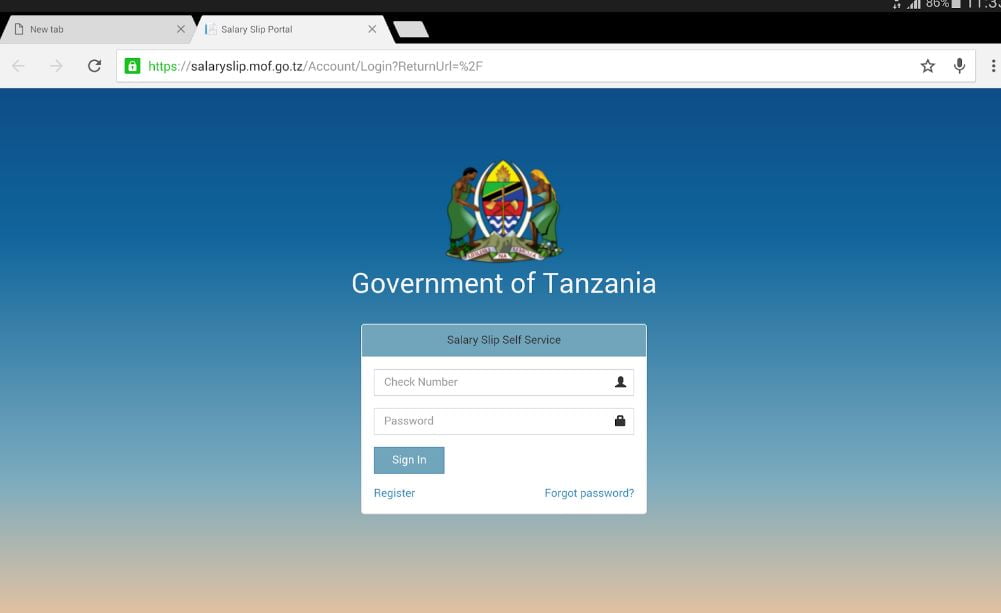

The Tanzania Salary Slip Portal registration process is quite simple. However, you need to provide some personal information to sign up. Below are the details that you need to keep ready before you apply for Salary Slip Portal online registration. The information and key points you need for Salary Slip Portal registration are:

Salary Slip Benefits for Employees: What You Need to Know

A salary slip is one of the ways employers can provide benefits to their workers. It details how much money the employee will be taking home each pay period, as well as accounting for any additional money the employee will not be directly receiving. A salary slip can also be known as an “end of year reconciliation” or a “statement of final accounts.” Employers have to fulfill certain obligations when it comes to providing benefits for employees. This includes sending out a W-2 form at the end of the year and issuing a 1099 if there was any sort of payment that exceeded $600 from that company in that tax year. Here are some things you need to know about salary slips and benefits for employees.

What is a salary slip?

A salary slip is a document that you receive from your employer at the end of the tax year, listing your gross annual income as well as itemized deductions. The salary slip is also the document you will be using to calculate your taxes when filing your yearly return. The salary slip is not the same as the W-2 form you will be receiving, which is used to report information to the IRS. The salary slip will be detailing what you’ve been paid in total at the end of the year, as well as listing any deductions that have been taken out. For example, if you have a 401k plan, your employer will take that amount out of your paycheck and put it into your retirement account.

How do you get a salary slip?

If you are an employee of a company and that company is deducting any amount from your paycheck, then you are entitled to a W-2 or a 1099 form by the end of the year. If you’ve been offered a job and you’re working for an employer, then you will receive W-2 forms at the end of the year detailing how much you were paid throughout the tax year. If you are an independent contractor, then you will receive a 1099 form at the end of the year if you made at least $600 doing work in a given tax year. You need to make sure that you don’t receive a W-2 form if you are a contractor, because the form will show your employer that you are an employee.

Tax benefits for employees

When you start working for a company, you will have taxes withheld from your paycheck each month. You will also receive a W-2 form at the end of the year that will have the information you need to file your taxes correctly.

In addition to the W-2, you may also receive a 1099 form if you received more than $600 from your company in a given year. When you receive these forms, it is important to review them to make sure everything is accurate. You may want to consider getting a second opinion or consulting a tax professional if you have any questions about your taxes. Adequately preparing for taxes will ensure that you end up receiving the full amount that you are owed.

Employee benefits on the Salary Slip

When you receive your paycheck each month, you will notice that there are additional benefits listed. In addition to salary and taxes that have been withheld, there may be some other benefits listed that are being provided to you by your employer. Some of these benefits may be in the form of contributions to your retirement account, health or dental insurance, or even a tuition reimbursement program. These benefits are usually very carefully calculated to fall below the amount that would require your employer to provide you with a W-2 form. This means that you are receiving the benefits without having to pay any extra taxes. Your employer is saving you money by providing these benefits without adding them to your paycheck.

Other benefits you can provide through the Salary Slip

There are many different ways that you can provide benefits to your employees without adding them to the paycheck. Some common options include setting up a 401k plan, providing a health or dental insurance plan, or offering a tuition reimbursement program to help employees pay off their student loans. It is important to note that, while these benefits are just as important as benefits that are added to the paycheck, they don’t always have to be provided through the company. In fact, the company may not be able to provide a certain benefit to all of your employees.

Company benefits for employees

When you are starting a new business, you have the option of starting your benefits plan right away. You have the opportunity to make your benefits plan as generous as you want. This also means that you have the option of starting small and growing your plan as your business does. In order to get started providing benefits for employees, you need to first decide on what type of plan you want to offer. You also need to figure out how much you want to contribute to each plan. It’s important to keep in mind that there are certain requirements that must be met when providing benefits for employees. These requirements include choosing a plan that is affordable for the company, as well as one that is easy for employees to access. You also need to consider the potential tax benefits that you may receive as a business owner.

Wrapping up

When you are working as an employee, it is important to understand the benefits that you have access to. This will help you to maximize the amount of money that you are bringing home each month. While many benefits are taxed, there are a few that are not. As an employee, it is important to know what benefits your employer is providing, as well as what benefits you are entitled to receive.

Download Namba ya NIDA Tanzania – Simple Steps

Requirements for Salary Slip Tanzania

Check number

Your names

Date of birth

Vote (for example 88Z2)

Subvote (eg 5007)

Account your bank account

Salary Scale (full of TGTS, TGS, n.k)

Salary Grade (filling B, C, D, E, e.g.)

Salary Step (will fill 1,2,3 nk). When Successfully registered, you will be redirected to the next page to fill it out

Phone number

email address

Password

Keep ready these things so you can get registration easily.

See also Selection Form One(1) Lindi 2021/2022 Kidato cha Kwanza

To access your online payslips, you must first register and provide an email address. You can get your payslip through the following links

How do I download my Salary Slip Online?

Log in to your company’s salary portal using your credentials.

In the profile section, check for the ‘Salary Slips’ option. …

Click on the ‘Payslip’ option.

You can view the salary slip as per the year and month.

Salary slip portal login

Salary slip portal register

Salary slip portal tanzania

Salary slip portal this month

Ggovernment salary slip portal

Salary slip portal forgot password

If you are looking for Searches related to salary slip and the following frequently asked questions you are in the right place.

Frequently Asked Questions about Salary Slip

salary slip portal Tanzania 2022

salary slip login

salary slip app

salary slip

my salary slip

kujiunga salary slip- How to open a salary slip?

view salary slip- How to view a salary slip in Tanzania?

msaada salary slip- Salary slip Help.

Salary Slip Tanzania Membership Registration Form (Government Employee Only)

Ensure all your information are the same as in Lawson System

If you are not sure of your details, please contact your HR Officer

For further assistance contact 0689 70 00 96, 0714 00 89 11, or 0766 74 71 14

How can I see my Salary Slip?

Result for salary slip

The employer prints or emails a pay stub or Salary Slip to the employee. Additionally, you may see the salary Slip on the employee’s internal site. The salary Slip will include salary and deduction information.

Can we check salary slip online?

If you need a copy of the employee salary/ pay slip, you can download it from the online salary portal, And the steps are So Easy. Kujiunga Salary Slip Online

Why do companies ask for salary slip?

When reviewing your pay stub with a copy of your recruitment letter, the majority of HR executives will have a clear understanding of your current CTC. Based on this, the new compensation will be negotiated.